Pre tax profit margin formula

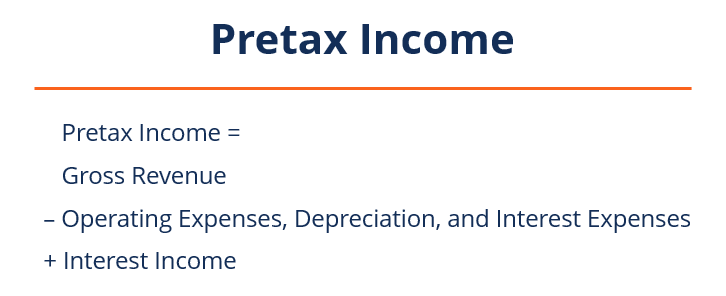

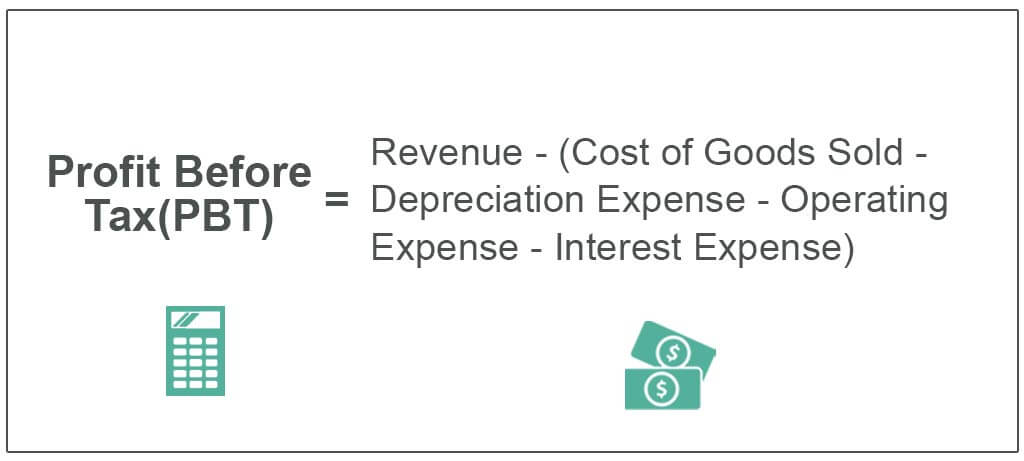

Profit Before Tax Revenue Expenses Exclusive of the Tax Expense Profit Before Tax 2000000 1750000 250000 PBT vs. Pre-tax Income Gross Revenue Operating Depreciation and Interest Expenses Interest Income What is the pre-tax profit margin.

Pre Tax Profit Margin Formula And Ratio Calculator

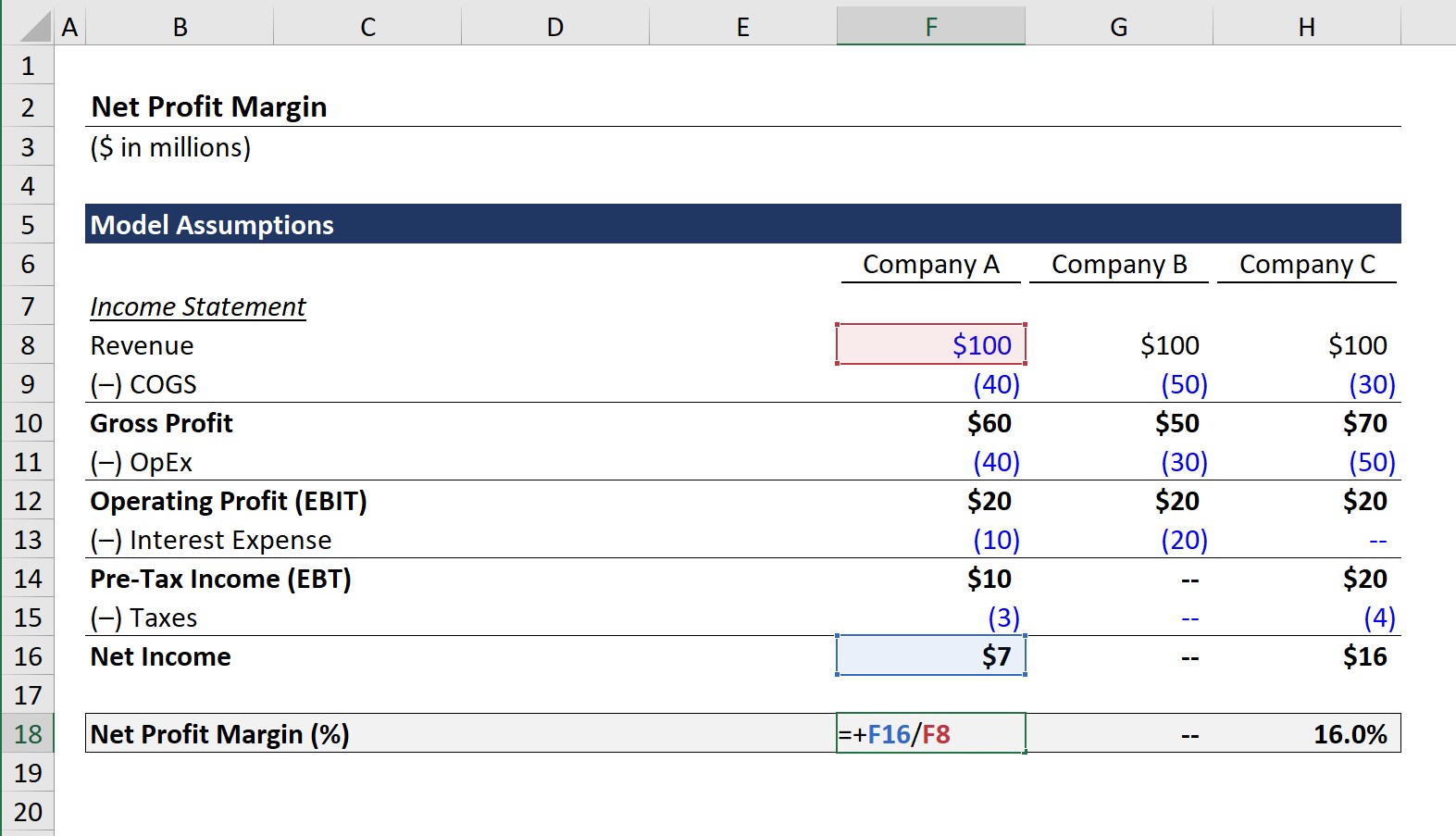

Pre-Tax Margin Formula Pre-Tax Profit Margin Earnings Before Taxes EBT.

. EZ Supply has pretax earnings of. Income Before Taxes divided by Revenue multiplied by 100 In other words you take the gross revenue subtract all expenses down to. To illustrate how to calculate Profit Margin we will use an example.

EBT ratio 100 EBT R EBT ratio 100 E B T R. A good margin can vary considerably by industry. Still as a general rule a 10 net profit margin is considered average a 20 margin is considered high or goo and a 5.

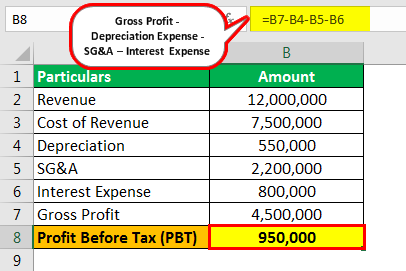

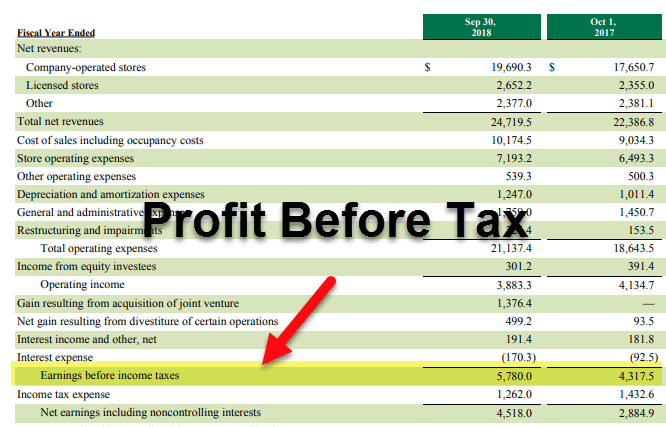

Gross Profit 4500000. Pre-Tax Margin 25 million 100 million 25 From there the final step before arriving at net income is to. The calculation of earnings before taxes is from subtracting the operating and interest costs from the gross profit 100000 - 60000.

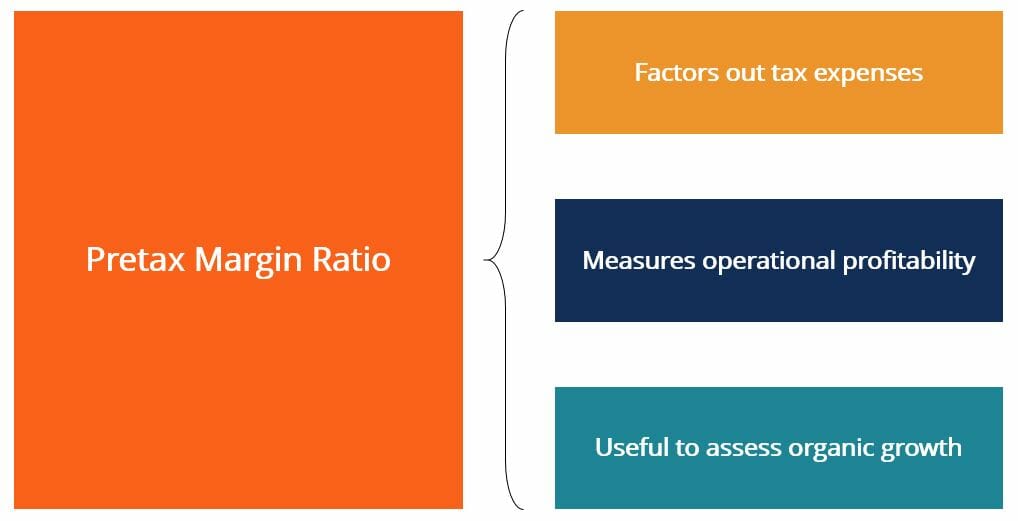

Pretax Operating Income - PTOI. A business with the following assumptions. EBIT Profit before taxes and.

About 1280000000 search results. The pretax profit margin is calculated by the formula. The next line is pre-tax profit which is calculated by taking operating profit and removing one off charges and interest paid on debts as well as adding in interest received on.

How to calculate profit margin. The pre-tax margin formula is calculated by dividing a companys earnings before taxes EBT by its revenue. Subtract depreciation SGA expenses and interest expense further to obtain profit before tax.

This is the formula for calculating pre-tax income. The pre-tax profit margin can be calculated by dividing the EBT by revenue. The pretax profit margin formula.

A good margin will vary considerably by industry and size of business but as a general rule of thumb a 10 net profit margin is considered. Therefore the calculation of PBT as per the formula. Pre -tax profit is a companys operating profit after interest on debt has been paid plus any unusual items -- but before taxes are paid.

An accounting term that refers to the difference between a companys operating revenues from its primary businesses and its direct expenses. Revenue 1000000 Cost of.

Pretax Profit Margin Formula Meaning Example And Interpretation

Profit Before Tax Formula Examples How To Calculate Pbt

Pretax Margin Prepnuggets

Net Profit Margin Formula And Ratio Calculator

Pretax Profit Margin Formula Meaning Example And Interpretation

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Pretax Margin Ratio Learn How To Calculate And Use The Pmr

Pretax Profit Margin Formula Meaning Example And Interpretation

Profit Before Tax Formula Examples How To Calculate Pbt

Profit Margin Conversation Window Cleaning Resource Community

Pretax Income Definition Formula And Example Significance

Profit Before Tax Formula Examples How To Calculate Pbt

Pre Tax Profit Margin Formula And Ratio Calculator

Pretax Profit Margin Formula Meaning Example And Interpretation

Pretax Profit Margin Formula Meaning Example And Interpretation

Profit Before Tax Formula Examples How To Calculate Pbt

Net Profit Margin Formula And Ratio Calculator